American Express Falls In Bailout Black Hole.

This is really getting scarier and scarier by the day..... American Express (AXP) is the next contestant in the

This is really getting scarier and scarier by the day..... American Express (AXP) is the next contestant in the $700 billion, $1 billion, $1 trillion, $2 trillion Black Hole bailout.

Delinquencies on American Express' cards have gone up as the U.S. mortgage crisis has affected they way some consumers pay their bills on time, or at all. For the 3rdQ, AXP set aside $1.4 billion for losses, up 51% from $905 million a year ago. As a result, net income for American Express dropped to $815 million, from $1.1 billion reported in the prior year quarter.

October 2008, marked the first month since 1993 that card companies were unable to sell bonds back by customer payments, and this effected American Express. On October 20th, American Express reported a 24% decline in its latest quarterly profit. Then on October 30th, American Express announced companywide "reengineering" initiatives. These initiatives included elimination of 10% of its worldwide workforce, approximately 7,000 jobs, reducing compensation expenses, cutting operating costs and scaling back investment spending. Suspended was management level salary increases for 2009 and a hiring freeze for open positions. The company said it expected this to produce benefits of nearly $1.8 billion in 2009.

Today, American Express applied to the Federal Reserve to become a bank holding company, and was approved, waiving the normal 30 day waiting period on the application, which was submitted on November 5th. The approval puts American Express, the nation's largest credit card company in terms of purchases, on the same footing as former investment banks Goldman Sachs Group and Morgan Stanley, which received Fed authorization to become commercial banks.

This approval makes American Express eligible for an infusion of capital from the federal government as part of the $250 billion rescue plan for the banking system and gives the company access to the Fed's discount lending window.

American Express has total consolidated assets of about $127 billion, the Fed said. The company already owns two bank units: American Express Centurion Bank, which operated as an industrial loan company under FDIC supervision, and American Express Bank, which was regulated by the Office of Thrift Supervision. Each has assets of about $25 billion and controls deposits of about $7.2 billion, the Fed said. Centurion is being converted to a bank, the Fed order said.

"In light of the unusual and exigent circumstances affecting the financial markets, ... the Board has determined that emergency conditions exist that justify expeditious action on this proposal," the Fed said in a statement.

"Qualifying as a bank holding company will provide American Express maximum flexibility and stability in this challenging economic environment," American Express said in a release.

Said the chairman and chief executive of the credit card giant, Kenneth Chenault: "Given the continued volatility in the financial markets, we want to be best positioned to take advantage of the various programs the federal Government has introduced, or may introduce, to support US financial institutions."

"The decision to become a bank-holding company does not fundamentally change American Express' core focus on the payments industry, nor will it require any significant divestitures," said Chenault.

In the filing, American Express said that its bank units have access to the Fed's discount window and the company already had enough cash to last more than a year.

The company's stock has tumbled 54 percent this year, the fourth-biggest decline in the DJIA. The 52 week high for the stock has been $60.00 and the 52 week low for the stock has been $20.50. The stock closed today at $23.98, down $1.33 or 5.2%.

The company's stock has tumbled 54 percent this year, the fourth-biggest decline in the DJIA. The 52 week high for the stock has been $60.00 and the 52 week low for the stock has been $20.50. The stock closed today at $23.98, down $1.33 or 5.2%.

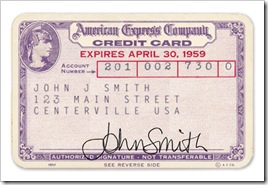

American Express started off as a shipping company in 1850, shipping products across the US. Their main customers were banks and they shipped various financial instruments like stock certificates and other notes. They began selling money orders and traveler's checks in 1882 and issued its first credit card in 1958.

SOURCES:

- Federal Reserve Bank Press Release, Nov. 10, 2008

- Bloomberg

- CNN Money

0 Responses to "American Express Falls In Bailout Black Hole."

Post a Comment